Why Category Management?

When we list some of the key benefits of the category management process, you can really answer the question of why you should choose strategic product grouping.

One of the primary advantages lies in the ability to identify key categories and drive significant sales growth. By honing in on these crucial segments, retailers can optimise their product offerings, capture consumer demand, and ultimately boost their bottom line. But that’s not all—it also holds the power to streamline organisational expenditure, leading to enhanced cost efficiency and improved profitability.

Moreover, this insightful process can open doors to new procurement category management cost opportunities. By carefully assessing and reevaluating sourcing strategies, businesses can uncover untapped savings potential, optimise supplier relationships, and achieve greater financial agility.

This Ultimate Guide will Cover:

- Category Management Definition

- Key Principles

- Strategic Sourcing Vs Category Management

- What is CPG Category Management?

- The Benefits of Managing Your Category

- What is a Category Manager?

- The Role of the Category Manager

- What is a Category Captain?

- The Category Management Process

- The 8-Step Cycle

- The MBM 73% Funnel

- Additional Examples

- Summary

- Further Reading and Resources

1) Category Management Definition

What we call ‘Category Management’ today developed from the concepts behind Efficient Consumer Response (ECR). This looked to increase the quality of services to consumers. It was achieved through close cooperation and a strategic product grouping process among retailers, wholesalers, and manufacturers. See our very own process and management meaning below.

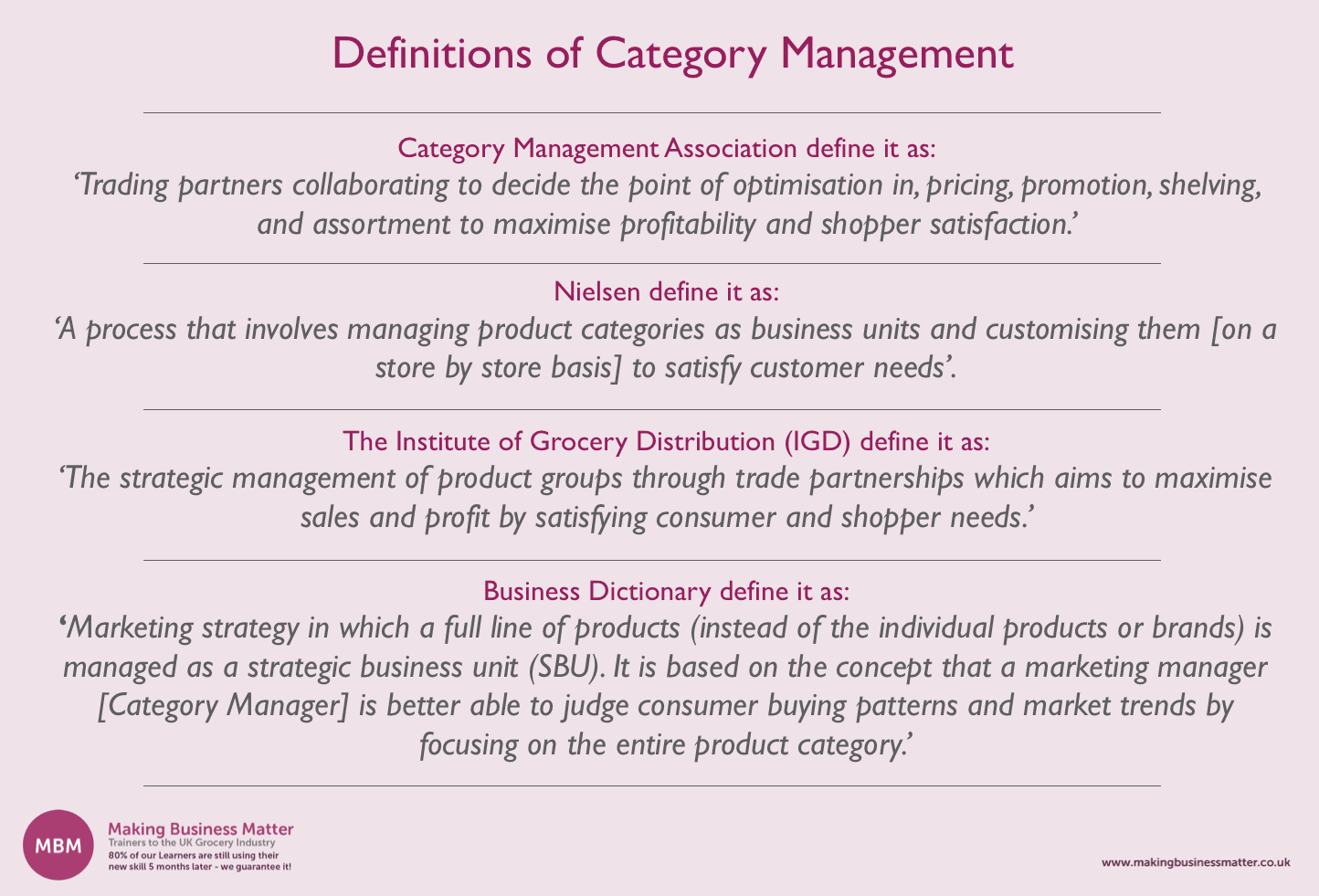

There are a few formal definitions of it, a situation that often leads to some ambiguity. However, the key definition is meeting the needs of the consumer in a better way through collaboration. Below are some examples.

Our Definition At MBM

We have formulated our own definition, and we use this approach in our training.

Our [Category] management meaning describes the process of dealing with and controlling things.

We see the approach to managing your product category as an essential activity. As a rule, we view it as a three-legged stool. It keeps the shopper, retailer, and supplier at the heart of decision-making. In that case, we see it as a ‘business as usual discipline’ that maximises every stage of the process. Our simple summary is:

- Identify more opportunities.

- Sell more opportunities.

- Land more opportunities, that meet the needs of the consumer.

Background on Category Management

The concept of Category Management or Category Planning originated in the late 1980s. It followed the research of the father of this concept, Brian F. Harris, a former professor at the University of Southern California. This process then greatly changed how retailers and suppliers worked.

Instead of retailers and suppliers competing with each other, it encouraged suppliers to work together with a focus on the consumer when making retail decisions. For the first time, the range of products a retailer offered was grouped with similar or related products. And this was based upon the consumer need that they met as part of the strategic product grouping process. Moreover, these ‘product categories’ were then managed as a strategic business unit (SBU). No longer as stand-alone products or brands.

What’s the Reasoning Behind Category Planning?

- Help suppliers and retailers focus on consumers when making retail decisions.

- Develop a strategy for differentiation and competition.

- A clear strategic product grouping process.

- Improve collaboration.

- Promote information sharing for better decision-making.

- Provide greater strategy when making tactical decisions.

- Clarify decisions about asset and resource allocation.

- Help clarify employee responsibilities.

This process allows for better management of the relationship between customers, retailers, and suppliers. Ultimately, all three parties moved towards a win-win-win situation. McDonald’s calls this the ‘Three-Legged Stool’. This is illustrated later down in this guide.

Watch Our One-minute Video to Hear and See More About It:

Darren explains the approach to managing your product category in this short video.

2) Key Principles of Category Management

The strategic product grouping process is founded on 5 key principles. These are cross-functional team approach, strong supply of market knowledge, making change happen, stakeholder engagement and facts/data-based.

Incorporate these category planning principles and align your supply chain practices. In turn, this will greatly increase the effectiveness of your approach to managing your product category.

Click on the image below for a larger version:

3) Strategic Sourcing Vs Category Management

Category management is not strategic sourcing but is a long-term approach to monitor trends, marketplace dynamics, and the supplier landscape within a particular area of spend and it is adjusted often to mirror the changing conditions of business.

Strategic sourcing analysis is conducted for imminent requirements. It is a one-time event, whereas category management analysis is continually refreshed with an end-to-end process. Moreover, it incorporates robust supplier management and demand management programme, whereas strategic sourcing does not. Regarding the latter, supplier development is an imperative inclusion, while strategic sourcing is not.

Furthermore, it places the full supply chain’s input, but strategic sourcing occurs in a silo within the organisation.

4) What is CPG Category Management?

CPG stands for Consumer Packaged Goods. Also known as FMCG (Fast Moving Consumer Goods). These are products that are fast-moving and of low cost. For this reason, they have a short shelf life. This is either a result of high consumer demand or perishability.

CPG/FMCG goods include meat products, fruits, vegetables, baked products, and dairy products. Therefore CPG product category optimisation is the skill of managing a group of these products within a retailer to best meet the shopper’s (consumer) needs.

5) The Benefits of Managing Your Category

A category in a retail shop contains brands from different suppliers. For instance, when brand X promotes its products, the sales of brand Y would go down keeping the overall category spend the same. One benefited at the expense of the other. In other words, X and Y competed with each other. As a consequence of this, there was no net gain in category spend for the retailer.

An Example:

For instance, Brand X sells 100 units in a week and Brand Y sells 100 units in a week. Therefore, the category sells a total of 200 units in a week. This is the category spend. Let’s say brand X promotes and gains 50 more units in sales. In the old system, this would mean, if Brand Y did not promote as well during that same week, it consequently lost 50 units to Brand X. Meanwhile, the category spend in the retail shop has not gained from X’s promotion. It still sells 200 units.

However, retailers recognised the need to grow their own businesses and to meet consumer needs better. To do such, they needed to change the way they worked with suppliers. This is where category planning comes in. The key premise is that all promotional activities need to benefit all — not just a single supplier.

For example, promotions, range layouts, and new product development (NPD), as well as existing product development (EPD), have to be in the interest of all and drive the overall category spend.

Share the Load

Furthermore, the supplier’s vast knowledge of the category could be pooled. Lastly, suppliers can share and help manage some of the workloads in growing categories. Thus freeing up retailers’ resources. At its core, product category optimisation is about improving results through retailer and supplier cooperation. As a result, this creates greater value for the customer, which increases category spend.

A wiser meaning is the expression of knowledge, experience and good judgement. Therefore, when we refer to the ‘suppliers vast knowledge’, we mean how wise they are.

As mentioned earlier, it’s a three-legged stool:

Concerns Surrounding the Process of Managing Your Products within a Retailer

A key feature of the Category Management process is the close relationship between supplier and retailer. However, this has led to fears that they might collude against the consumer, as well as undermine free-market principles. In the UK, there are strict antitrust laws in place to promote fair competition and prevent cartel behaviour.

In 2007 several major supermarkets were found to have worked with their dairy suppliers to fix market prices. They added an extra 15p to the price of butter and cheese. In addition to this, they added 3p to milk. As a result, it is estimated to have cost consumers an extra £270m. Consequently, the Office of Fair Trading fined them £116m.

However, this is notably rare. Generally, the consumer benefits from the closer working relationships a category planning process brings.

6) What is a Category Manager?

A Category Manager is a staff member in charge of a category. Their main responsibility is to maximise the category spend and profit of the category. In essence, their role is all about driving sales. To do this, they need excellent analytical skills. In particular, they need to be able to assess and translate data into meaningful information. This should help increase sales in their category (category spend), which is the essence of managing your product category. In doing so, they will also be better at meeting the needs of the consumers.

The Category Manager is an expert and knows how to manage their category. They have in-depth knowledge of the products in their category. Furthermore, they are held responsible for the successes and failures in the category.

A key part of managing your product category is to use the necessary knowledge to work with retailers. In particular, retailers should benefit from the in-depth knowledge of the category manager. They can use the information they provide to understand how consumers shop in the category. In addition, they will have their products placed and presented in the best way possible at the store.

What Does Category Mean?

Category is a class of things grouped together, because of their shared characteristics.

What is an Interim Category Manager?

Interim Category Managers are employed for a pre-specified length of time to achieve a specific business objective or target. Typically this is on a 6, 9, or 12-month contract with remuneration set at a daily rate. On average this can range between £250 – £500 per day.

What is a Category Development Manager?

The line between an Account Manager and a Category Manager is becoming blurred. A Category Development Manager is the person who manages the account. Some companies choose to separate the National Account Manager and the Category Manager, while others blur the lines.

The titles are almost irrelevant. The key is that both the supermarket’s and the shopper’s needs are met because achieving both of these needs delivers the best performance.

What is a Category Executive?

A Category Executive is a staff member still learning product category optimisation. Indeed, they work under the Category Manager. Also, their responsibilities are primarily collecting data and analysing the category. Specifically, they identify opportunities and report to the Category Manager, who then takes appropriate steps.

Category Executives support the Category Manager to achieve their KPI’s. A great Category Executive learns what a great Category Manager does, and aims to become one.

Category Manager Salary

According to Glassdoor, pay for Category Manager jobs in the UK varies across regions. The range is between £34,000 and £69,000. Currently, the national average is £45,675 a year.

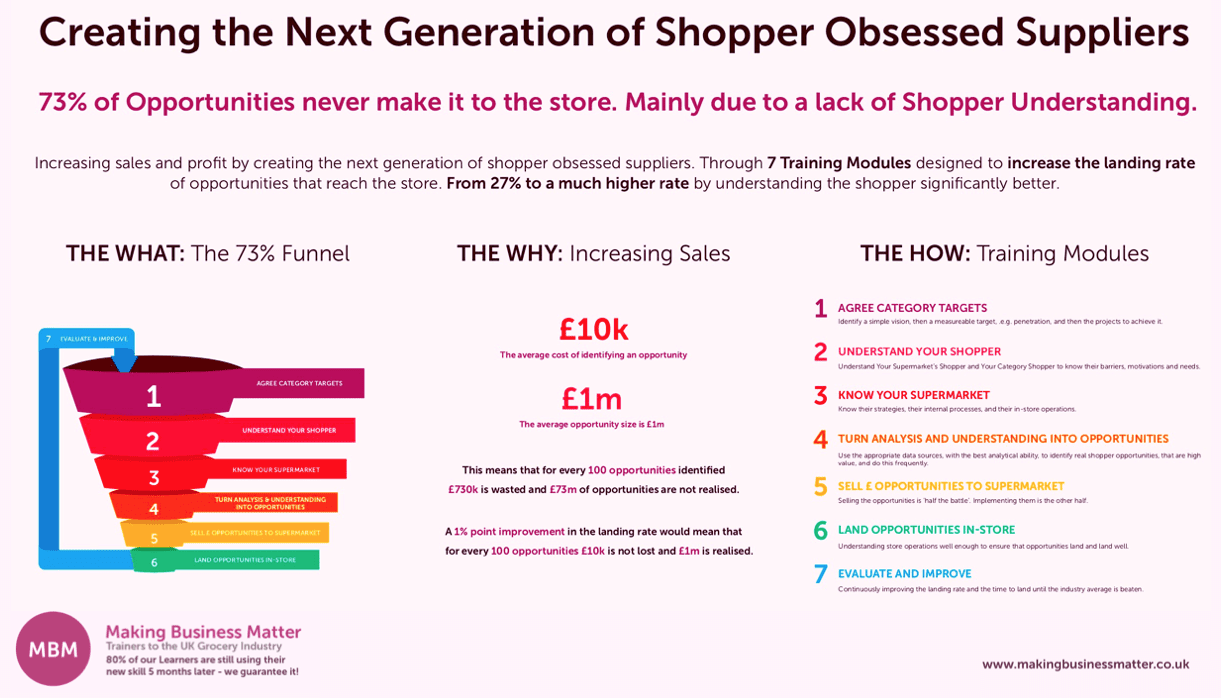

Category Management Consulting

Category planning grouping consulting and support help in-house Category Managers maximise opportunities and win more for the store.

Here at MBM, we provide category management training and consultancy services to ensure insights are identified that get products to the store, are placed on the right shelves, and, most importantly, go into shoppers’ baskets.

In other words, our consultants help deliver greater insight into Category opportunities.

By following our unique 7-Step Process, the MBM 73% Funnel, our training, and consultancy will help Category Managers develop greater shopper understanding. This, in turn, will help increase the landing rate of opportunities that reach the store, helping Category Managers to compete more successfully.

Project-Based Category Management Support

Project-based Category Management support helps when there is a specific project or strategic product grouping goal that is looking to be met within a set timeframe or contractual period.

Interested in Managing your Product Category?

You May Wish to Learn More About Net Revenue Management…

Net Revenue Management is about managing sales and profit. This term has become popular in recent times and is largely considered a data-driven process. Using shopper data to drive decisions. All in all, it is to improve the performance of products, so that category spend, sales, and profit increase.

Read our Net Revenue Management article to find out more, and learn how the MBM NRM Tool Pyramid © can help you. For a further understanding, take part in our Net Revenue Management Training Course.

7) The Role of the Category Manager

The Category Manager is the person who builds a close working relationship with the customer, and the retailer. This allows them to give useful consumer and category insights. Their main task is to be the key influencer of category strategy and tactics.

A Category Manager’s key role is to recommend strategies and activities which benefit the whole category. As earlier noted, a retailer treats categories as stand-alone strategic business units. They define strategies as plans of action formulated to achieve an end goal/long-term aim.

Consequently, all actions they take should benefit the overall profitability of the category. Through the use of data and analytics, strategies should always look to deliver overall category growth. Furthermore, their efforts should have a positive impact on shopper satisfaction.

This may include:

- Changes to the assortment.

- Pricing recommendations.

- Range reviews.

- Develop new point of sale (POS) materials.

- Revamped planograms.

Category Manager Responsibilities

Below, is a list of the key responsibilities of Category Managers:

#1- Undertake Periodic Range Reviews:

This is to consider new lines, seasonal lines and new consumer trends. Category Reviews are important to maintain category growth.

#2- Review of Rate of Sale:

Reviewing the rate of sale (ROS) will help ensure that the range is profitable and includes the best-selling lines. Moreover, it should also deliver consumer choice. Indeed, consumer choice should be at the core of all Category Planning decisions.

#3- Track Customer Loyalty:

Key metrics of customer loyalty need regular monitoring. These will include:

- Repeat purchases.

- The frequency of purchase.

- The weight of purchase.

- Product penetration.

- Switching analysis.

The key 3 are WOP FOP and PEN. Weight of Purchase – a shopper buying more on a trip, Frequency of Purchase – a shop buying more often, and Penetration – a shopper buying from the category.

#4- Ensure Space Optimisation:

This means avoiding out-of-stock products and maintaining a profitable product assortment.

#5- Execute a Fixture Strategy with the Retailer:

This will focus on visual merchandising, considering, flow, brand blocking, and multi-location siting for products. In the end, all fixtures need to be easy to shop and profitable. The merchandising definition can be described as the act of promoting the sales of goods, specifically by their presentation in retail outlets.

#6- Analysis of Promotional Activity:

Promotional activity analysis is about understanding the most effective mechanics in driving trials and sales. In other words, it involves the tracking of sales and promotional support by the stock-keeping unit (SKU). Indeed, it is important to make sure that they complement each other.

For example, SKU ‘A’ may have a higher share of promotional support than it makes in sales. Reallocating some promotional events to other SKUs could add positive sales to the category, increasing usage and penetration.

What is Category Analysis?

Category analysis is the skill of analysing a category. Many people can analyse the data. But effective category analysis aims to identify opportunities that provide a win for the Shopper, the Supermarket, and the Supplier – The 3 legged stool. A win-win-win.

Many Category Managers analyse the category, yet they only regurgitate the data onto Powerpoint slides, which they then present to their Buyers. Effective product category optimisation requires the Category Manager to spend a lot of time analysing the category to identify opportunities. Then to present not all their ‘workings out,’ but why specific opportunities should be seized.

8) What is a Category Captain?

As discussed earlier, each retailer contains many categories. In fact, the average UK supermarket could contain as many as 100 categories. Milk, for example, is a category or ready meals.

To maximise sales, each category needs to be actively promoted. Understandably, however, the retailer doesn’t have a huge depth of knowledge (and analysis) of the intricacies of each category’s product or brand. They, therefore, outsource this to an expert. Outsourced Category Management is where the ‘Category Captain‘ comes in.

Typically, the Category Captain, or as it is sometimes called ‘Category Champion,’ is a leading manufacturer or supplier within the category. For instance, for ‘Breakfast Foods,’ the appointed Category Captain could be The Kellogg Co. Or, for ‘Packaged Beverages’, it might be Coca-Cola or PepsiCo. The retailer appoints them for their ability to manage a specific category. This is often regardless of their size or turnover. It is, however, due to a particular skill and expertise in identifying, coordinating, and delivering opportunities.

By appointing a Category Captain to lead the category, the retailer benefits from their in-depth category knowledge. Furthermore, they will often take the lead in broader aspects of managing your product category. This may be by coordinating and managing promotional plans or overseeing larger and more in-depth category-wide plans.

Additional Advantages of a Category Captain Include:

- Existing investment in consumer research.

- Detailed knowledge of pricing.

- Knowledge of the correct products to offer, e.g. sizing.

- Extra insight for in-store displays and presentations.

- Knowledge of inventory and forecasting to ensure products are always available.

Typically, they are the eyes and ears of the high street for the buyer. They are often their first port of call.

What is a Category Management Specialist?

Within product category optimisation, there are two types of category specialists; people and companies. A person that is called category specialist is someone that focuses on one category long-term. For example, a supermarket wine buyer would be one. This person is likely to work in wine for most of their career. A company category specialist is a company that focuses on winning that category. For example, Quorn are experts in the meat free category.

Excuse the Interruption, But Here’s a Little Bit about How to Make Learning Stick

We are the soft skills training provider, partnering with clients that are frustrated by people returning from training courses and then doing nothing differently. Our clients choose us because we achieve behavioural change through our unique training method, sticky learning ®.

Click the banner below to learn more:

9) The Category Management Process

This process is structured and data-rich. In particular, it is about organising categories into independent business units. Furthermore, it provides a framework for retailers and suppliers to work together. The results are, greater profitability, efficiency, and added value for shoppers and customers.

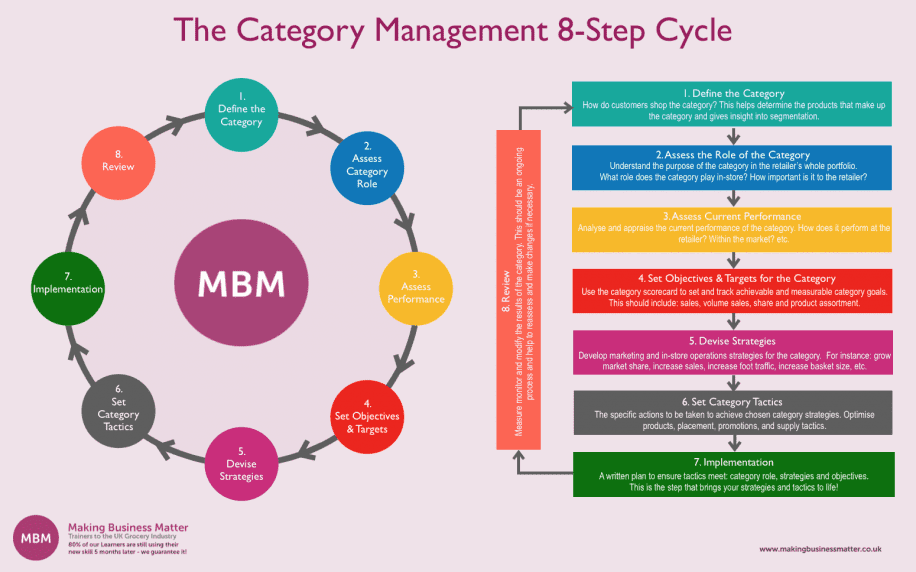

10) The Category Management 8-Step Cycle

The most famous model for a product category optimisation process is the 8-Step Cycle. Brian F. Harris developed it with the Partnering Group in 1997. This is sometimes called the ‘Brian Harris Model.’ The model is a formal and structured category process/plan or set of actions to follow. The model has evolved over the past two decades.

You can find it in different forms where it has been adopted. The name often varies between ‘process’ and ‘cycle.’ In addition, some Category Managers follow a five or six-step category process or category plan. Nonetheless, most of the key elements are included, as we will discuss further below.

Click the image below for a larger version:

Step 1. Define the Category

A category should consist of products that serve the same or similar purpose. They will likely belong together in the minds of the consumer. Therefore, an effective Category Management process requires Category Managers to consider how consumers shop the category when defining it. For example, the category might be any product that ‘goes in a fruit bowl’, as shoppers think in simple terms, not in complex structures.

Category Planning is about increasing the overall sales and profitability of the category as a whole. Within the individual category, some items will deliver different levels of profitability. They will also need to meet different consumer needs. We, therefore, need to develop subcategories to break it further down. This allows for the execution of different strategies.

Let’s consider how this works in the ‘Soft Drinks Category’ for a moment.

Below, is a list of some of the subcategories:

- 150ml cans for fast consumption.

- 330ml cans for sole consumption immediately.

- 500ml resealable bottles for when you’re on the go.

- Low (or zero) calorie vs. standard.

- Reduced sugar vs. standard.

- 1.0l / 1.5l / 2.5l bottles for sharing with the family at home.

- Larger bottles for parties or special occasions.

- Multipacks for packed lunches.

- Limited editions and seasonal.

This is an example of how all of these subcategories of the soft drinks category might look on the shelf:

Further Examples of Managing Your Product Category in Retail:

Let’s now think about the ‘Cereals’ category. Retailers may segment Cereals into one of the following:

- Hot v Cold Cereals, where usage, or season, is important.

- Adult v Family v Child, where the emphasis is on the consumer, and packaging is the priority.

What Does ‘Business Category’ Mean?

A business Category is a group of products within a supermarket/retailer. Categories are defined by the business to make managing your product category easier. The proper way to group products is by how the shopper or customer sees those products. For example, if a shopper shops fruit, they group fruit into ‘every day,’ ‘special’ and ‘other’.

Therefore the categories are those 3. The supermarket should then manage those as categories, ensuring that products within those categories are not promoted at the same time.

Challenges for Category Managers

Challenges can occur, for instance, where categories could not logistically sit together in the store. For example, the ‘Milk’ category. This seems an easy and obvious category to define. Yet, it poses a logistical problem.

Fresh milk, which needs to be chilled, and UHT milk, which needs storing at ambient temperature. Typically, this is resolved by creating a ‘Super Category’, such as ‘Milk’. This is then further segmented into ‘Fresh Milk’ and ‘Ambient Milk’.

Another Challenge

This might be the concept of a ‘World Foods’ aisle in the store. This clearly takes into account the consumer decision tree. It follows the thought process many of us take when deciding upon an evening meal — for instance, choosing between a Chinese or Mexican meal. Presenting them side by side responds to research in this area.

Furthermore, defining a category can become tricky when deciding on lines to include. Consider ‘Snacks’. This is often segmented into crisps and nuts. It is then further divided into single packs, sharing packs, and multipacks. Clear definitions are critical to the strategy for the category.

For instance, retailers and suppliers will look at the size threshold for when a single pack becomes a sharing pack. Or whether Pringles is a crisp or a snack!

Step 2. Assess the Role of the Category

Now that we have defined the category, it is necessary to decide its role. It is important to consider how the category will work in-store, and how it fits with the retailer’s whole portfolio. Assess the role of your categories and how they relate to each other in-store. This will aid in understanding the total basket profitability of your customer.

It is important to check the potential profit margin for both the retailer and the supplier. All efforts surrounding the category should be consistently contributing to its purpose or ‘category role.’ This is important to ensure the efficient allocation of resources. That resources go to the most deserving categories. For instance, categories with large share and/or positive outlook and/or capable of driving footfall in-store.

The following are 4 types of consumer-centric category segmentations. These can be used to help assess the role of the category:

Destination Categories

This is one that drives footfall into the store. It is also a deciding factor in the choice of a store by a consumer. For example, a store that is well known for excellence in its fresh bakery, sandwiches, or a range of beers. These may not be highly profitable categories but have a significant investment in them by the retailer and supplier.

In areas, such as range, space, and availability, it can enhance consumer loyalty to the store and deliver consumer traffic. These Categories will tend to be 5-10% of the total category count.

For example, a Delicatessen is considered a showcase for the store.

Core Categories

These account for 50-70% of the categories. They are regular, frequent-use, products. For example, milk, snacks, bread, biscuits, confectionery, coffee, and tea. These are the categories that compete heavily in terms of price, space, and promotions.

Convenience Categories

Convenience categories account for 10-20% of categories. Generally, these have less space in-store and fewer promotions. They complement the retailer’s assortment of products. Typically, these are products not usually found on a routine shopping list.

However, this category aims to guarantee a one-stop-shopping experience. Furthermore, its premium pricing plays a vital role in enhancing margins. Categories such as shoe polish, greeting cards, and electricals are typical examples.

Seasonal Categories

These account for 5-15% of the store offering and, by definition, have a seasonal bias. This will dictate space, range, price, and promotions. For example, ‘cereals’ will adjust in favour of porridge in the winter and revert to ‘ready to eat’ (RTE) cereals for the rest of the year.

Another aspect of Seasonal Categories is, for brief periods, that they become ‘Destination Categories.’ Take, for example, fireworks on November 5 (in the UK), or roses on Valentine’s Day. This can also generate sales in Core Categories for reasons of consumer convenience.

Step 3. Assess Performance

Category assessment is the periodic review of categories and subcategories. It is a regular appraisal of the current performance of the category. This step involves evaluating retailer sales and customer data. It will help decide the sales, share, and profitability of the category.

Furthermore, you will need to do an in-depth analysis of key competitors. As a starting point, perform a detailed SWOT analysis. This will show useful category insights. For instance, where more investment may yield greater profits. You may, for example, discover that focusing on innovation or adopting an aggressive pricing strategy could help. You may also find that re-categorisation is necessary.

HFSS Example

A recent example is the introduction of the ‘Sugar Tax’ in the UK and the upcoming HFSS High Fat Sugar and Salt legislation. A re-categorisation of soft drinks may be required to adapt to the changes in legislation. Suppliers will play a major role in this analysis. They often bring data-driven evidence from agencies such as Kantar, Nielsen, and IRI.

Suppliers will also have access to shopper research and proprietary retailer data, such as Dunnhumby or Wal-Mart (Asda) Retail Link. This is for their own lines only. Note, ‘Category Captains,’ however, will have access to the full service. The insights gained from this part of the product category optimisation process are significant. The data is rich and highly detailed, providing information on:

- Volume.

- Top sellers.

- Top profit-generating lines.

- Out of stocks, and quantification of lost sales.

- Basket analysis (e.g. most common combination of products in the same basket).

- Top, and worst, performing stores.

- Time of day analysis (e.g. when is the peak selling time for a product?).

For further insight, take a look at our helpful and effective tools to help identify the size of the opportunity for your category.

Step 4. Set Objectives & Targets (Scorecard)

Following category assessment, the next step is to set achievable and measurable goals for sales, volume and margin. This information should be tracked in a Category Scorecard. A very common document within FMCG suppliers. It will help you track:

- Sales Value / Category Spend

- Volume Sales

- Share

- Product Assortment

Step 5. Devise Strategies

Which strategy is right for each category to meet its goals? The process is circular within this part of the business process. The supplier and retailer are building strategies which, in turn, determine the category role.

Here are seven strategy examples:

#1- Traffic Building Strategy

Traffic Building lends itself to ‘Destination Categories.’ The aim is to attract the consumer into the store – and for them to buy from the category. However, this strategy is also used to attract consumers to ‘Core Categories.’ This is because of price sensitivity, promotions and frequent purchasing benefits from shopper traffic. The most obvious example is petrol. It draws consumers from a wide area. They can then shop in the parent store.

#2- Turf Protecting Strategy

This is about defending existing sales and market share. It is in response to competitor activity and is, in its nature, a reactive strategy. Consequently, it has ramifications for profit margins. Therefore, it is used as a last resort. Nonetheless, it is important for the perception of the store and it also maintains (a level of) competitiveness.

#3- Transaction Building Strategy

Used to quickly build sales of a particular category by selling larger volumes. The goal is to drive up the average weight of purchases per visit. It is achieved through packagings, such as multipacks and larger packs. Also, through aggressive pricing and promotions. Examples would be, ‘Core Categories’ such as ‘Crisps’ and ‘Soft Drinks.’

#4- Profit Generating Strategy

This strategy emphasises the high-margin categories or subcategories, which also command high consumer loyalty. They are, therefore, less price sensitive. This, for example, may include a retailer’s ‘Own Brand lines.’

#5- Excitement Generating Strategy

The strategy is about creating excitement in a category, or subcategory. Often by innovation, or tapping into a relevant and current social trend. Typically, this falls into the ‘Seasonal Category.’ For instance, new flavours of ice cream are introduced during a hot spell. At times, this can also fall into ‘Core Categories.’ For example, ‘named’ cans of Coca-Cola or limited edition of chocolate bars.

#6- Cash Generating Strategy

The focus here is on large volume, high turnover categories. Those that bring balance to the retailer’s cash flow.

#7- Image Enhancing Strategy

This strategy focuses on the intangible aspects of the retailer’s offering. Those that improve the overall image and engender loyalty. For instance, quality, variety, price, service, convenience, presentation and delivery.

Step 6. Set Category Tactics

Category tactics are the tools in your planning toolkit. They enable category strategies to be fulfilled. These include:

- Pricing

- Promotions

- Availability

- Product Assortment

The supplier, particularly the ‘Category Captain,’ will be expected to lead the data analysis. This helps them to decide the level, frequency, and timing of tactics. Furthermore, it will also depend upon insight from agencies such as Nielsen, Kantar, and IRI. The adoption tactics will vary by retailer, store and SKU. For instance, an SKU may have a ‘Destination Category’ in one retailer, and a ‘Convenience Category’ in another.

Step 7. Implementation

Arguably the most important step of the Category Management process. That is because it involves executing the plan that you have already developed in steps 1-6. This is where the planogram comes into play.

The planogram is a computer-developed diagram showing retailers where and how to display category products at individual stores. It is, in fact, the embodiment of Category Planning and is the most effective method for executing the plan in-store. It ensures the correct mix of products, with the correct adjacencies, is implemented.

Furthermore, the planogram also ensures that it is at the correct price where shoppers interact with the category.

What is the Role of the Merchandising Manager?

Merchandising managers will often manage a team of space planners to create the plans. Alternatively, they will outsource to merchandising companies with display optimisation experience. Their role is to maximise the return on shelf space. They will also consider ease of shop, which is very important because the easier a category is to understand for the shopper, the more they will buy.

An example of poor ‘ease of shop’ is wine, which is why so much is sold on promotion because shoppers don’t know what to buy.

Consequently, the goal is to make the shopping experience more pleasurable and less stressful. This is achieved by following industry-standard space planning principles, such as:

- Merchandising by product subcategory.

- Displaying cheapest to the left.

- Positioning large products on the lower shelves.

Accurate implementation of the plan is important. Moreover, it is key to make it as easy as possible for the store to put in place. Imaged plans with product images sourced from companies, such as Brandbank, can help do this. It is also possible to take the planogram one step further and use virtual reality technology.

Using VR can help to improve planogram legibility. Many merchandising managers agree that this approach increases in-store compliance. After implementing category plans, the retailer now monitors the profitability of the category. For example, ‘Canned Soup,’ is now treated as one unit. Each brand is no longer considered in isolation.

Step 8. Review

The 8-Step Category Management process requires regular review, and changes, where necessary. This is because it is important to keep up with relevance in a changing business environment. Furthermore, category dynamics often change. Strategies and tactics need to adapt to stay competitive. As a result, this is a critical stage of reflection and analysis of earlier assumptions.

Typically, a review of successful Category Planning would expect to see:

- Cost reductions through supply chain management, such as, out of stocks and wastage.

- Improved consumer satisfaction. For instance, availability and ease of store navigation.

- Increased market share, versus competitor retailers.

- Increased sales and improved margins.

Limitations

In our interview with Mark Taylor, the author of ‘Who Killed Category Management’, below, he discusses some fascinating limitations of rigorously following the process:

A Streamlined Process

The average grocer in the UK has over 100 categories which means that each category will have a full category plan every 2 years – if it’s lucky! Following the 8-Step Cycle fully takes between 16 and 24 weeks (excluding implementation). It requires a team of at least 12 people and involves the completion of between 60 and 100 different data templates.

Furthermore, it requires an external consultant or facilitator to organise and run each category plan. Consequently, it is often poorly implemented and generates mixed results. It is still relevant today, but in a more streamlined version and more applicable, for example, only when you are doing a ‘Big Category Plan.’ Above is an adapted version, which is a little more pragmatic. We’ve identified the areas which will very rarely change and require fewer resources.

Moreover, we also show the things that are part of your day-to-day strategic product grouping. These become easier to complete as you’re always doing them. Lastly, we highlight the areas where we believe you should be focussing the most attention and resources. These are the areas that, if you invest the time, will give the greatest benefit. However, don’t forget the need for constant category review.

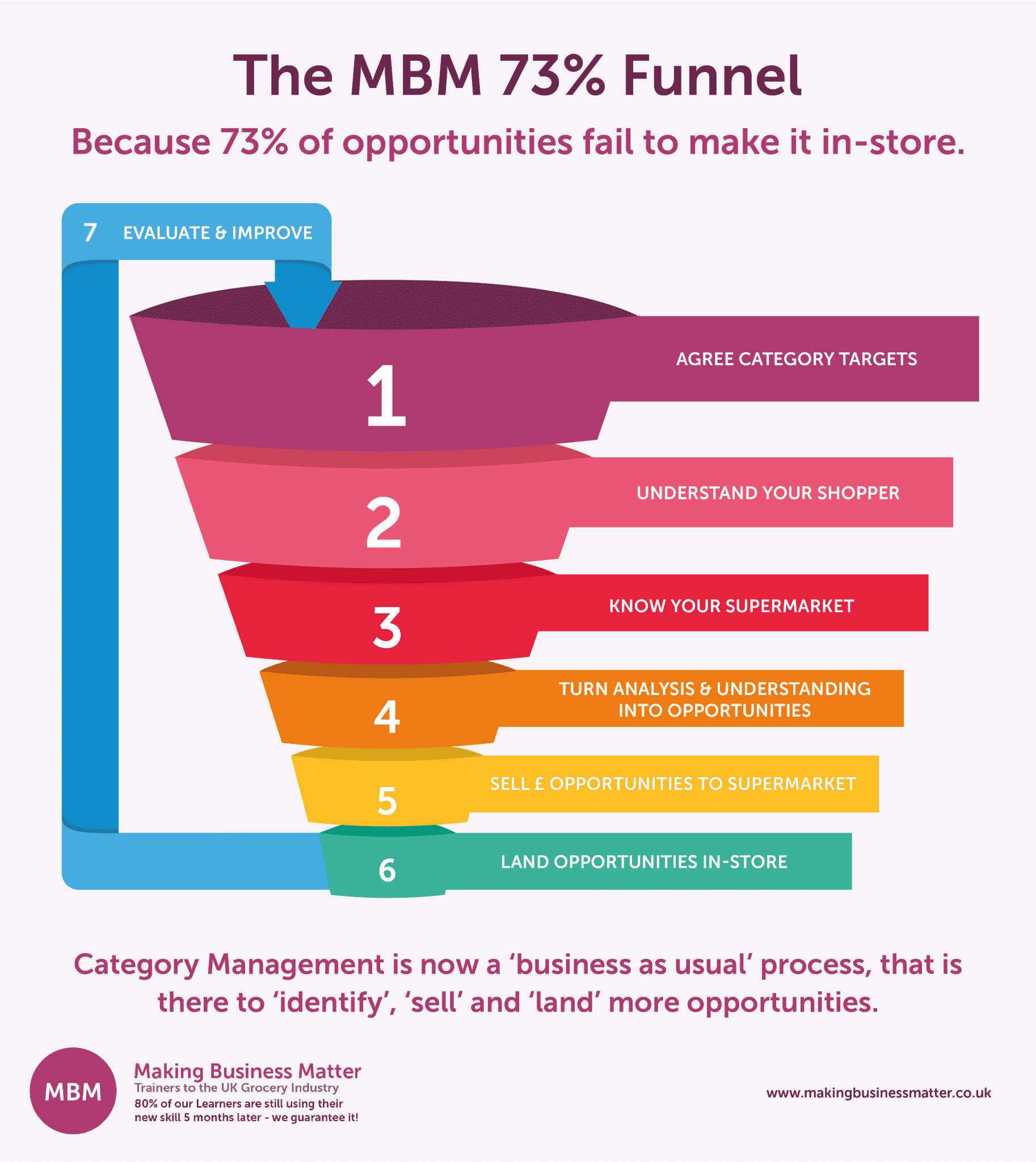

We’ve further adapted this into something that we feel is a little more relevant for today, The MBM 73% Funnel.

11) The MBM 73% Funnel

Our research into product category optimisation landing opportunities arrived at an astonishing conclusion.

73% of category opportunities fail to make it in-store”

Often due to a lack of understanding of the needs, motivations, and barriers of the shopper. Here at MBM, we devised the funnel to help Category Managers focus, and ‘funnel down,’ on what is important.

The idea is that by following this process, you will develop a greater shopper understanding. This, in turn, will help increase the landing rate of opportunities that reach the store. In essence, we believe managing your product category is a ‘business as usual’ process that is there to ‘identify,’ ‘sell’, and ‘land’ more opportunities.

#1- Agree on the Category Targets

Often, we find category managers fail to have agreed on a specific target for their category. Thus, they have no idea if it will be achieved. Without targets, you will have no idea where you are going, or indeed if you are already there.

In short, the category is like a ship sailing on the ocean with no destination. Effective Category Management is, therefore, impossible. This layer of the funnel accounts for 8 points of the 73% failure rate.

We suggest choosing one of the following:

To encourage…

- More people to buy from your category (Penetration).

- Existing customers to buy your category more often (Frequency).

- Customers to buy more from your category on each visit (Average Spend).

The choice is a simple one, and should only be one of the above. We say only one as, for instance, often, an increase in penetration may result in a net decrease in the frequency of purchase. If you focus on all three at once, your tactics will likely fail.

#2- Understand Your Shopper

We have found that most Category Managers only focus on one-third of the overall ‘Shopper’ opportunity. The in-store customer. Missing two-thirds of the ‘customer.’ Understanding only a small part of who buys the product. This, in part, brings us back to the old Customer vs. Consumer question.

You should (hopefully) have noticed in this article that we use the term ‘consumer’ when we discuss the user of a product and a need being met. Likewise, we use the term ‘customer’ when we discuss the in-store purchaser. To reduce confusion, we at MBM like to use the following labels: ‘Shopper,’ ‘Preparer,’ and ‘Eater.

‘Read about a case study that sought to understand the bagged salads shopper. This was published in The Grocermagazine. Find out about how Florette started to put clear blue water between them and their competition.

#3- Know Your Supermarket

How aligned is your Category Management to the goals and needs of your Supermarket? We all know that you can’t fit a square peg in a round hole. For instance, do you know their strategies? Internal processes? In-store operations?

Knowing your supermarket is essential. If you don’t, you’ll always be chasing your buyer because they’ll be trying to navigate the guidelines, restrictions and processes, whereas you could have when you presented. Awareness of these things will help you develop category tactics that fit. This layer accounts for 9 points of the 73% failure.

#4- Turn Analysis & Understanding into Opportunities

Many Category Managers get lost in the minefield of category data they have. Unfortunately, they often fail to correlate the best sources of data with the correct analytical tools and skills. As a result, they rarely find deep insight and category opportunities, becoming data regurgitation. Someone that just takes the data and presents it in a nicer way. This is because they fail to develop hypotheses before they start.

By identifying hypotheses before you begin analysing the data, you will be more focused on category sales opportunities. We like to think of it as a targeted approach. This layer is responsible for 12 points of the 73% failure rate.

#5- Sell £ Opportunities to Supermarket

Only 27% of opportunities ever make it in-store. Selling the opportunity can be the toughest part. A lot of hard work has gone into understanding and identifying the opportunity. Yet, so many suppliers fall at this hurdle because they have not considered alternative ways to engage the Buyer. They simply create a slide deck. How would you feel sitting in front of a desk and being talked at for an hour 5 times a day?

Our founder, Darren A. Smith, was once asked to meet a supplier to hear feedback from consumers. The frozen carrot consumer. A small part of the portfolio at best, yet important to the Supplier. They presented for 3 hours with over 128 slides! This funnel layer accounts for 13 points of the 73% failure rate.

Product Category Optimisation e-Learning

Do You Want to Become a Category Ninja?

On our e-Learning Category Course, we show you alternatives so that you can build up your toolkit.

#6- Land Opportunities In-Store

Making sure that your recommendations to your Buyers don’t just look good on paper, but that they also will land well in-store. Often described as ‘the last 100 yards’ of Category Management, store operations are often forgotten or ignored.

As a Category Manager at a supplier, you have a responsibility to close that gap too. We can no longer abdicate responsibility for understanding stores to the Buyer. This layer of the 7-layer funnel accounts for 12 points of the 73% failure rate. Failing at this last hurdle will mean that all your hard work has ‘gone to pot.’ The range/the promotion/the NPD will probably only last less than 12 weeks in-store.

A little like the MD of a pizza company. He once shared his story about his joy and dismay at getting into McDonald’s. A long story short – they had got into McDonald’s. All the hard work had paid off.

One of McD’s requirements is that you work in a restaurant for a day. The MD obliged. The first order came in and was via the window (Drive through). Delighted. They cooked it, and took it to the window. But it would not fit through the window!

#7- Evaluate & Improve

We quickly move from one project to the next, without knowing how to make the next project better. It is essential to understand how to measure your performance as a Category Manager and to improve continuously. Consequently, your target is to beat the industry average for landing rate and time!

We believe that this seventh layer accounts for 6 points of the 73% failure rate. A low amount. Nonetheless, how will you ever be better, earn more, and impress your boss, unless you know what went well and what didn’t go so well? The best salespeople in the world are told to evaluate, evaluate, evaluate. Hone your pitch. Write down your script. Seek feedback. Category Managers should do the same.

12) Additional Examples of Managing Your Product Category

The process of managing your product category is no longer the exclusive property of the retail industry. Key learnings from it have been implemented in other areas. We will explore and discuss some of these below:

Category Management Procurement / Purchasing / Category Procurement / Procurement Cycle

The concept of Category Management has evolved. No more is it the sole reserve of the customer-facing retail industry. In fact, it is now an essential strategy to adopt for all purchasing and category management/category procurement decisions. Applying the fundamentals of Retail product category optimisation to purchasing can lead to reduced costs of goods, reduced supply chain risk, and increase the overall value of the supply base.

Peter Hunt (ADR International) describes it as:

..the term category management can mean different things to different people, so a working definition is needed. A ‘category’ is the logical grouping of similar expenditure items, such as spend on advertising agency services or IT hardware. [It] ..is the sourcing process used to manage these categories to satisfy business needs while maximising the value delivered from the supply base.

What is Category Management procurement?

A category procurement strategy groups products based on the ability of the market to supply. As previously noted, it helps to grow sales and profits by maximising synergies. It has also removed unproductive competition between brands. In doing so, it doesn’t restrict itself to organisational boundaries. At its core is a process that uses cross-functional teamwork — people working together to deliver a product using a robust procurement cycle.

How has the Category Management Procurement Process Altered?

Some of the benefits are:

- It has extended engagement and teamwork with stakeholders.

- There is a greater process of governance across organisational boundaries.

- The depth of category-specific knowledge can be shared.

- An emphasis on the use of planning and analytical tools, such as a procurement cycle.

While this approach spans many industries and is beyond the remit of this guide, it is interesting also to consider how developments have led to changes in FMCG. I.e., how it has altered the approach to purchasing and category management procurement in our industry.

Benefits of the Procurement Approach

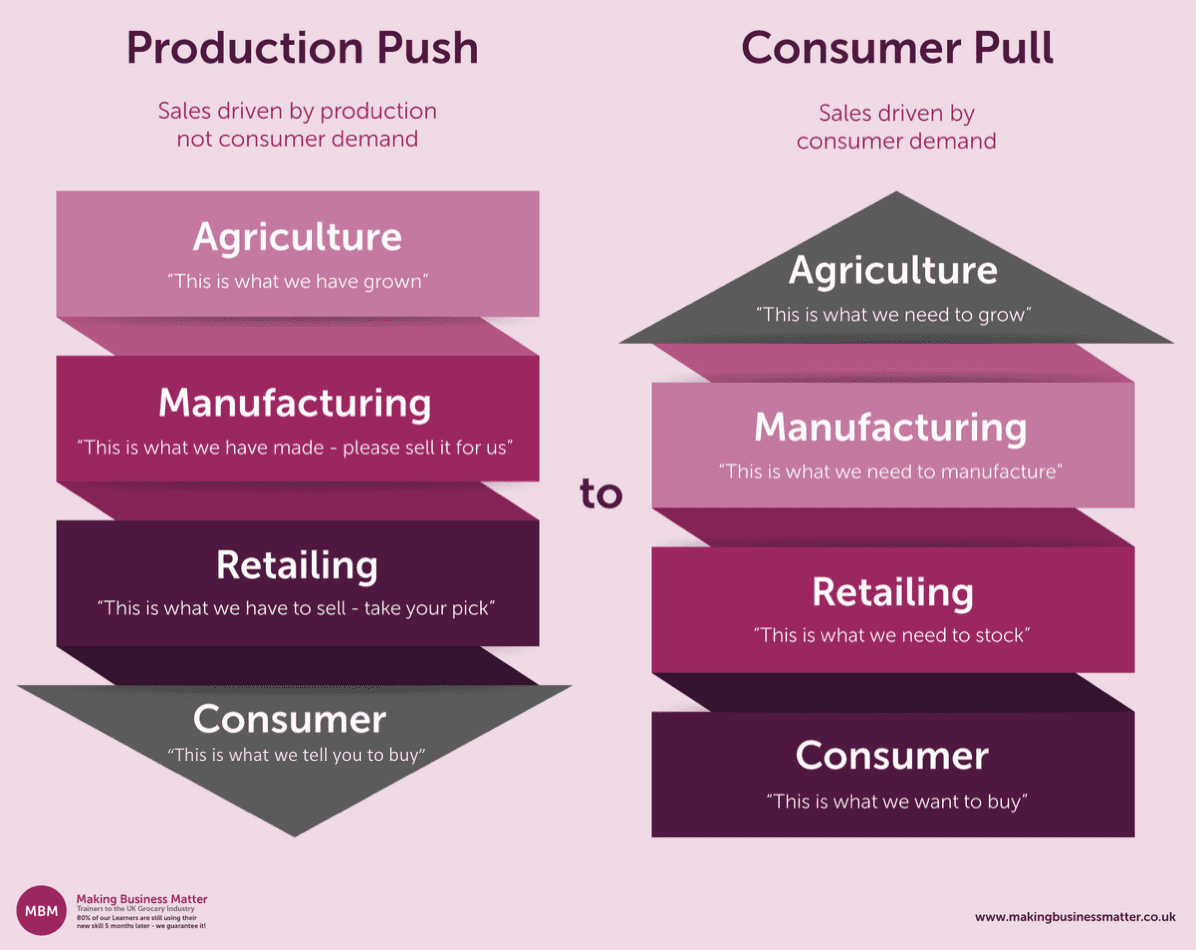

We now know what category management procurement is. So what are the benefits? A key benefit is the role it now plays in the wider procurement cycle and supply chain within retail. Simply put, it is about sourcing or getting the goods you need to fulfil your business model.

Historically, grocery sales were driven by what we call a ‘production push.’ In essence, the supply chain decided what they wanted to make/grow. Now by using data and analytics to drive strategy, what we’ve learned from managing categories has changed this.

Decisions made by Category Managers are based on two key things, efficiency and meeting a consumer need, because of this, sales are now driven by consumer demand. As a rule, we like to call this ‘consumer pull.’ In this case, through data, consumers are telling us what they want to buy. Consequently, it is the role of the supply chain to respond to this and offer it, often considering how it benefits the procurement approach.

What Drives Your Sales?

Category Planning encourages more communication and end-to-end thinking. For this reason, category procurement and purchasing now work closely with supermarket-facing teams. Therefore allowing them to give the customer what they actually want to buy and when.

What is a Category in Marketing?

Marketing has categories whereby shoppers (consumers) are grouped into similar categories. Similar to supermarkets grouping products to merchandise, marketers group consumers in categories. This is to make it more manageable.

An example of a product category optimisation ‘marketing category’ could be penetration. Wanting to sell the product to new consumers that have not tried it before. The tactic might be to reduce the price to reduce the risk for a new consumer. Or another marketing category might be trip spend – wanting to get current shoppers to buy more when they buy the product. For instance, a tactic would be ‘Buy two, and get the third free.’

13) Summary

Category Management is a structured, analytical and data-driven approach to the decisions taken in-store. To maximise category and retailer profitability, execution of the Category Planning process is vital. Consequently, it relies on effective management and implementation of activities, supported by analytical tools that enable accurate decisions to be made.

14) Further Reading and Resources

Take a look at our selection of helpful resources below. Each will help you win more opportunities and become a better Category Manager:

#1- Read this Ultimate Guide in Other Languages

Click to read in Chinese or Spanish:

#2- Product Category Optimisation Training

Take a look at the image below to see how our classroom-based Category Management Training or our online e-Learning Category Course can help you to achieve more. Please contact us for further information.

The What, The Why, and The How

Our trainers are from your industry. They can provide training on any one of our products, from Myers Briggs and Negotiation Skills to Executive Coaching, Time Management Skills, and Presentation Skills, using our unique Sticky Learning methods.

What Our Clients Have Said About Us:

“MBM really helped us to pinpoint the areas of category understanding that offered us the greatest opportunities and then transformed how we talk about Category across our business. They are challenging and will ask difficult questions to get the best out of your team and the knowledge within. More importantly, the flexibility of their approach means the project is tailored precisely to your objectives and MBM will keep you on track throughout. Most importantly their retail experience helped us distil a complicated and broad project into simple, meaningful and actionable pieces which buyers understood and welcomed. Project Clear was hard work, great fun and genuinely business transformational”.

-Tony Walsh, Category Controller, Florette.

#3- Watch Our Videos

Click below to see our YouTube channel and playlist with more tips:

#4- Read Our Glossaries

Read our glossary for a complete definition and A-Z of key terms. Additionally, feel free to take a look at all of our soft skills glossaries.

#5- Read Our Blog

Take a look at our award-winning blog for more useful information and tips for Category Planning, and Category Management E-commerce. You can also read our book reviews, including Mark Taylor’s ‘Who Killed Category Management?’.

Other Articles from Our Blog:

- Managing commodities

- Category manager skills

- What is category management?

- Brainstorming Techniques