We All Have a Soft Spot For Dear Old M&S

There is something decent about them. We all (used) to go to school in their skirts, shorts, and shirts. We all (used) to wear their knickers and boxers. However, for the last 30 plus years, they have been slowly losing their marks and sparkle. A result of self-admitted harm and a slow turning of the screw by savvier rivals. Something M&S’s latest results sadly allude to.

The Jewel in the Crown

For many years M&S’s food business had been the only untarnished jewel in the crown. On arriving 2 years ago Chairman, Archie ‘Asda’ Norman quite rightly set his sights on the food business as the engine to turn around M&S’s fortunes.

M&S’s results this week show what a gigantic behemoth of a supertanker he still has to turn. Moreover, turn in a very different direction from that in which it is currently facing.

M&S Results in Numbers

A food business smaller than the Co-Op at just under £6bn of sales and in like for like decline of -0.3% and a margin decline of 140 basis points year on year (source: M&S Results: Annual Report 2018). Quite an achievement in a market where there is a modicum of food inflation and M&S should you would think have little problem selling higher added value products at higher margins.

The Challenge of Scaling Up Premium

Archie Norman in his Chairman’s introduction to the 2018 Annual Report talks about ‘recognition of the unvarnished truth’. Unfortunately, the unvarnished truth is that he is trying to crack a conundrum that hitherto has proved impossible. How do you take a premium proposition and scale it to mass market growth without losing your ‘Premiumness’?.

Chief Executive Steve Rowe puts the task facing M&S as such: ‘so that we can retain our core customers and attract busy families who want great tasting, quality food at outstanding value’.

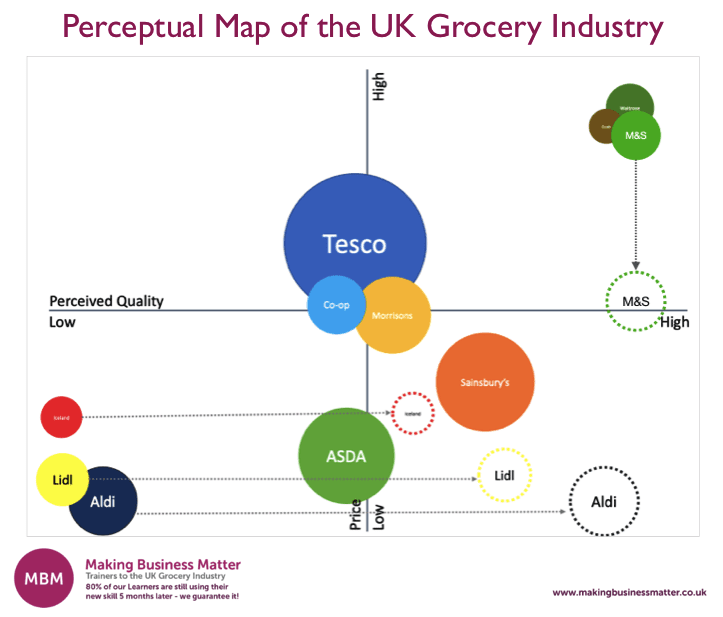

Much, much easier said than done and even harder given the proven strength of the competitors. Those he will have to usurp in order to gain any sort of growth in the crowded middle ground of UK grocery retailing

Competitor Advantage…

It’s much, much easier to do it the other way around. Move from mass, mid-market to a more premium position without losing your heartland sales. Something Tesco has shown with its Finest ranges. Furthermore, it has been achieved supremely by Aldi and Lidl, as indicated below:

They have managed to masterfully attract mass market volumes across all demographics. Achieved through a combination of rock bottom priced, decent quality base range products. All interspersed with outstanding quality and outstanding value premium products.

You have to look to the car industry for an example of how to achieve top to mid-market supremacy. The German premium car makers seem to have managed to crack the conundrum.

Mercedes and BMW are now the respective third and fourth largest sellers of new cars in the UK (source: SMMT). They, however, have managed to retain their premium position as well as their premium brand perception. By morphing into financial services sellers and harnessing historic low interest rates, alongside the high residual values of their used cars, to sell us, the great British public, sandwiched PCP loans at monthly instalments other manufacturers can barely compete with.

Answers for M&S

Unfortunately for M&S the ‘unvarnished truth’ is that although they too can and do sell us sandwich deals, food has very little residual or resale value and most (but certainly not all) of it is bought for cash rather than credit!

Perhaps the answer and Archie Norman knows and talks about it, is that M&S’s travails are as much internal and structural as they are external and market driven. An industry embarrassing 92.4% availability on Food (source: M&S Results: Annual Report 2018) is a good place to look for your next 7% sales growth for example.

It will be an interesting journey for M&S. They talk about their 5-year turnaround plan to make M&S ‘special’ again and a vast majority of the British public will I am sure wish them every success. But will they vote with their purses, wallets and contactless cards?

The proof of the pudding will be in cleverly mixing hard-nosed commercial business performance with an offer shoppers see as great value, value for the exceptional and expected quality. In short, a very difficult recipe to cook up. Let us hope we see a tempting, delicious, gooey melt in the middle success from M&S in the next five years and not a flat, fizzled out souffle.