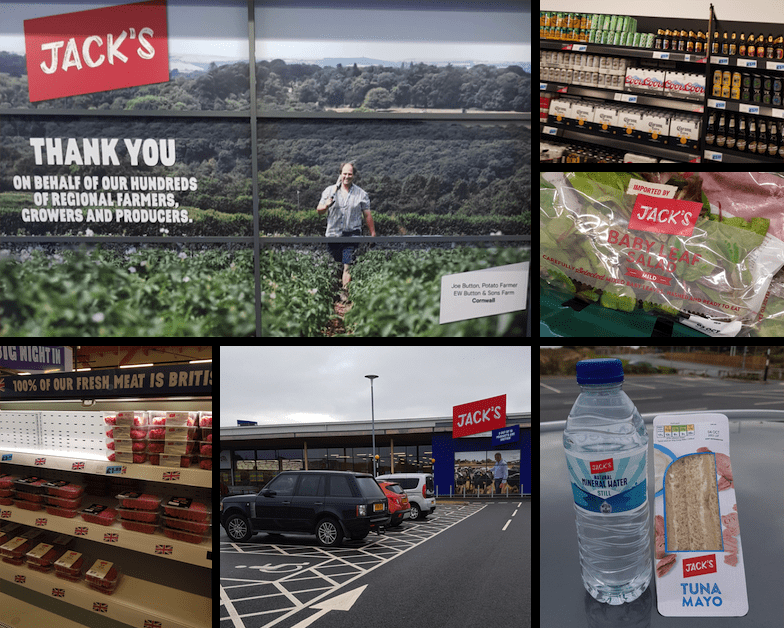

Tesco Jack’s – The Format

As the format – ‘limited range discounter’ – suggests it caters for a base. It’s a ‘fill the cupboard and refrigerator’ shop and offers little else. But it does what it does well. This begs the 64 million dollar question – if you put a Jack’s next to a standard Tesco supermarket or superstore how much of the standard store’s trade would switch? On what we saw on our visit we’d put at tenner of our own hard earned money on a good 40% at least!

Which begs an even bigger question. A £50 billion pound Tesco sized question. So what is Jack’s raison d’être, what is its purpose?

Tesco won’t, or currently can’t, answer the question. CEO Dave Lewis on opening day said he would rather cannibalise the sales from his own stores than lose them to a competitor. But at what cost to Tesco’s stated, and as far as the City is concerned, guaranteed aspirations to build its net margins back to 3.5% – 4.0% by 2019/20?

Future Positioning

Perhaps the answer lies in Tesco’s 172 Metro stores. Those unloved, un-invested in, urban orphans of the greater Tesco empire. Tesco itself admits they are too big, stock too wide a range, and are expensive to operate and staff. Until now they have had no solution. Aldi and Lidl are pretty fastidious about their property model. Only building standardised, efficient low-cost sheds on relatively cheap brownfield sites. Typically, outside of expensive city centres (although Aldi is talking of moving into Central London amongst others).

So, what about a central urban food discounter? With a limited range, efficient and cheap to run, it’s only real competitors being very small, range restricted and relatively high priced convenience stores and the woeful offer of the pound stores. It could be a very clever, winning masterstroke by Mr. Lewis and the Tesco team. Based on their track record over the past couple of years where they haven’t put a foot wrong, we won’t be betting that tenner of our own money against them!